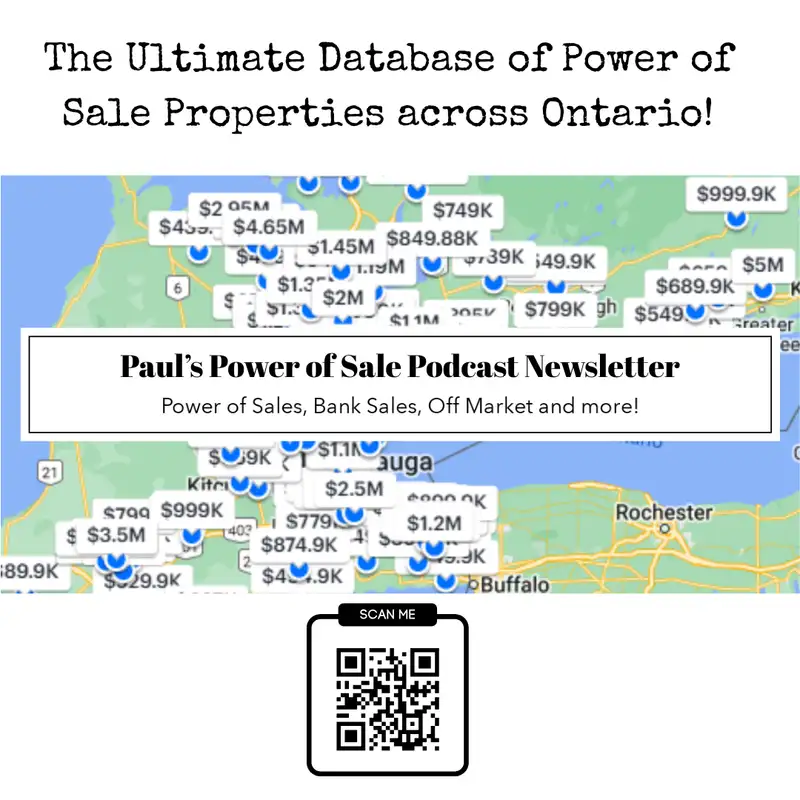

Welcome to Paul's Power of Sale podcast newsletter, the only one of its kind in Canada.

Understanding the differences between power of sales and foreclosures is important

before you start your buying journey.

Today, many Canadians find themselves facing rising mortgage rates.

This situation can lead to a

power of sale, a process initiated when homeowners default on their loans.

A power of sale occurs when you skip mortgage payments.

Your lender has the right to sell your home to recover their funds.

It's important to know your mortgage terms as they dictate how the lender can

act. Here's how a power of sale works, specifically in Ontario.

After defaulting, your lender waits 15 days to issue a notice of sale.

This notice includes the amount owed, interest, and payment deadlines.

You'll have 30 to 40 days to repay your debts, known as the redemption period.

If you can't pay, the lender can sell your home. If your mortgage lacks a power

of sale clause, lenders may wait three months before selling,

needing a 45-day notice.

Once sold, the proceeds pay off your debts and any excess money returns to you.

People often confuse power of sale with foreclosure.

In a power of sale, the lender aims for the highest sale price,

giving any leftover amount to the homeowner.

In foreclosure, the lender takes ownership and keeps any profits.

A power of sale is common in Ontario, New Brunswick, PEI, and Newfoundland.

It's usually quicker than foreclosure as it doesn't require court approval.

Lenders must provide a notice in advance. For example, in Ontario,

they give a 15-day warning before the sale process starts.

Other provinces also have specific timelines for notices.

Can you stop a power of sale? Yes, you can if you act quickly.

Bringing your mortgage back into good standing may help you avoid losing your

home. But what can you do?

Consider selling your home to settle debts. Another option is to renegotiate

your mortgage terms with your lender.

Taking out a second mortgage or applying for a personal loan could also help you recover.

Interested in buying a power-of-sale home? Keep in mind that the lender sells at fair market value.

Be prepared to purchase in its current condition without any negotiations for

repairs. A home inspection can provide essential insights.

In summary, if you're struggling with mortgage payments, contact your lender promptly.

Take advantage of your redemption period to repay. If necessary,

consult with real estate professionals for assistance.

Act now to protect your investment and ensure future security. Don't wait for crisis.

Stay informed and ready. Sign up today for this powerful newsletter.

Comment below with OK for your invite link.